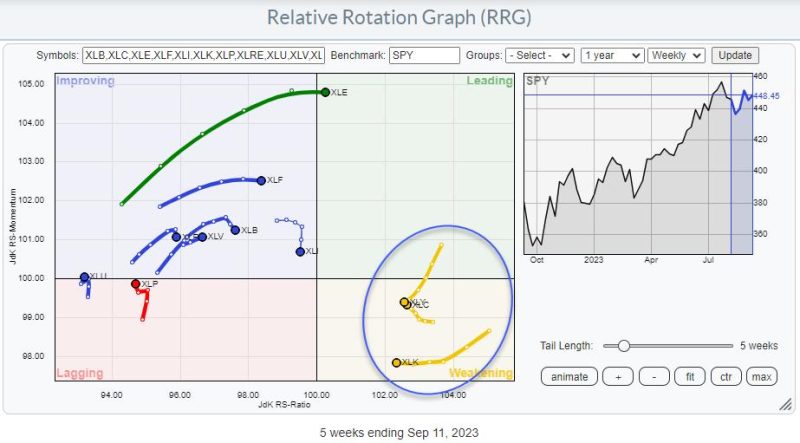

It looks like a strong rotation to the Leading RRG Quadrant is around the corner for three sectors, as per the reports. This could be a great opportunity for investors who are considering entering into these three key markets.

It is said that it is the start of a rotation of funds into the strongest performing sectors, including Discretionary, Financials, and Technology. This could also possibly apply to the overall market itself, as investors continue to search for the best opportunities and hope to take advantage of them in the coming months.

The Reason Behind It

As per the research on Relative Rotation Graph (RRG), there is a strong indication of sector rotation taking place. This is when investor preference shifts from one sector to another, as they respond to the performance or outlook of certain stocks in a sector or industry. For example, when the Technology sector has performed well, investors may start to shift their assets away from sectors like Financials into Technology.

For the three sectors mentioned, there is a strong momentum seen in the recent weeks, suggesting that this rotation may indeed be taking place. The Discretionary sector has seen significant inflows while the Financials and Technology sectors have had relatively impressive performanc.

Şome people believe that this could be an ideal opportunity for new investors to take advantage of the changing market conditions and allocate their funds accordingly.

The Forecast Ahead

It is hard to predict exactly how this sector rotation will develop, or how long it will last. However, some believe that the current situation may present an opportunity to capitalize on market trends and invest in the strongest sectors based on performance and outlook.

Investors should also take into consideration that sector rotation is not a guarantee of success. Markets can be volatile and unpredictable, and therefore the value of any investments can go up or down. It is important to diversify investments and not only focus on one sector.

Conclusion

In conclusion, it looks like a strong rotation to the Leading RRG Quadrant is around the corner for three sectors. This could possibly be a great opportunity for investors to capitalize on the changing market conditions. However, it is important to remember that sector rotation is not guaranteed to bring success. Investing should be done in a diversified manner and with appropriate risk management strategies in place.