It seems like the world is on the brink of chaos more than ever before. People are anxious and uncertain about the future as a result of unpredictable economic issues, political unrest, and global health crises. To make matters worse, the future appears so bleak that it’s almost impossible to predict what awaits in the coming days and weeks. As a result, it is imperative to use data and metrics to gain a better understanding of the challenges and potential doom threatening society.

This article takes a closer look at three charts that can be used to track impending doom and prepare for the worst.

The first chart is the Trading Economics Recession Index. The Recession Index measures the risk of a country’s economic contraction by using a formula parameterizing variables such as unemployment, retail sales, and real growth rates. Since the index increases as the risk of recession increases, a higher index score indicates that a recession is more likely within the forecast period.

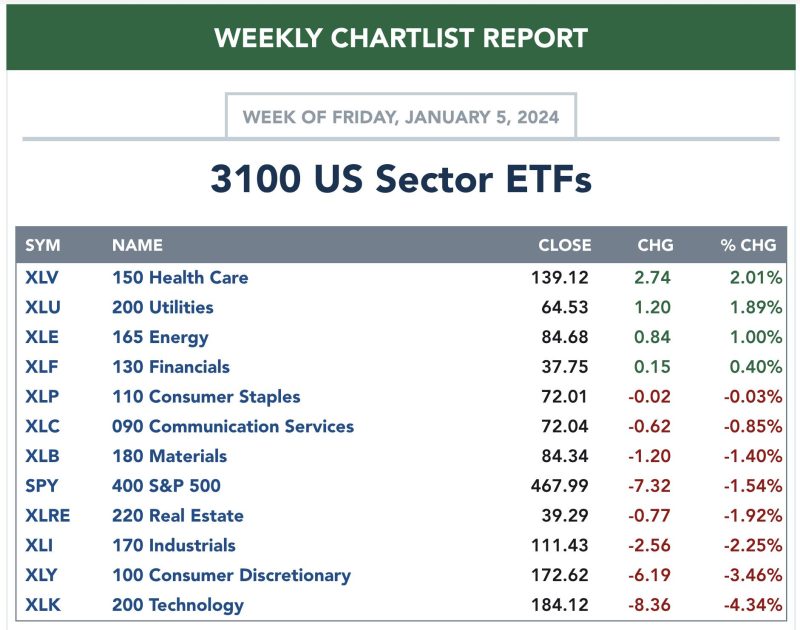

The second chart is the Stock Index Chart. This chart displays the performance of major stock indexes, such as the Dow Jones Industrial Average (DJIA) and the S&P 500. The performance of these indexes, which can be highly predictive of an economic downturn, can indicate the potential impending doom of the economy.

Finally, the third chart is the Consumer Confidence Index. The index measures the degree of optimism that consumers feel about the country’s current economic and employment conditions. As the Consumer Confidence Index decreases, consumer spending decreases, ultimately leading to a potential recession.

Although these three charts are just pieces of the puzzle, used together, they provide an important overview of the state of the economy. Knowing when and where impending doom is likely to occur is a crucial step in preparing for and preventing a potential economic crisis. This is particularly important for businesses, as they need to be aware of the risks associated with a recession in order to take precautionary steps to protect their companies and employees.

In conclusion, the three charts described above—the Trading Economics Recession Index, the Stock Index Chart, and the Consumer Confidence Index—can be used to track impending dangers and prepare for the worst. By using data analysis and informed predictions about economic trends, individuals and businesses can protect themselves from potential economic doom.